There are many construction loans available for funding residential construction projects. The most popular one today is the 203k FHA Construction Loan. The two versions of the 203K Building Loans have emerged as a popular option among today’s home buyers and property owners wishing to make improvements to a property. Today, we’ll be looking at the pros and cons of this option as well as explaining the 203k loan rates.

There are many construction loans available for funding residential construction projects. The most popular one today is the 203k FHA Construction Loan. The two versions of the 203K Building Loans have emerged as a popular option among today’s home buyers and property owners wishing to make improvements to a property. Today, we’ll be looking at the pros and cons of this option as well as explaining the 203k loan rates.

Which version of the 203k construction loan is right for you?

These FHA programs are known as the Standard 203k and the Streamline 203k.

We Help You Qualify For A 203K Construction Loan

Fill Out The Form Below To Get Help Today!

New FHA Construction Loan

The FHA Construction To Permanent Mortgage Program is a short-term building loan that transitions into a permanent FHA loan after you build the home. A loan lender first approves a constructor who is going to do all the renovating, and the Federal Housing Administration insures these types of new construction loans so that loan lenders feel more secure. Thus, they will give out more money up-front for fewer requirements.

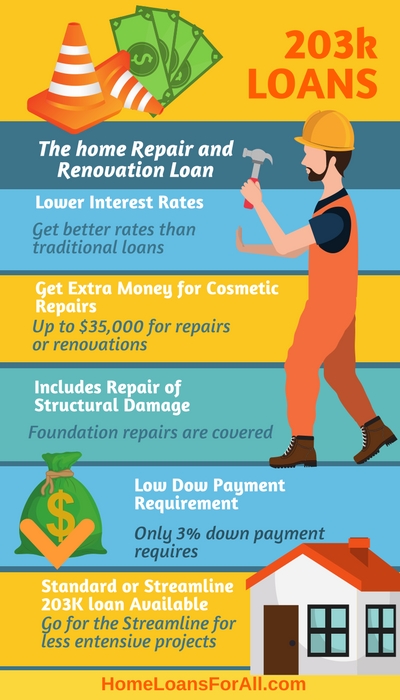

FHA construction loan requirements are lower than the requirements for other types of construction loans, and they have smaller down payments. 203K mortgages are a type of FHA construction loan that is best for an existing home that requires repair or rebuilding. As we mentioned before, there are two kinds of 203K FHA Construction Loan:

Standard and Streamline

In short, the standard one covers major renovations like structural work or work that costs more than $35,000. The 203k Streamline is for non-structural work under $35,000. We will cover these two in more detail further on, so don’t worry.

FHA Loan and how it works

The FHA is not a home loan lender. Rather, it’s an insurer of home loans. As an insurer, the FHA offers a backstop to home loan lenders who make a loan that meets the agency’s specifications for insurance.

Renovation is not only cosmetics! Renovation should ensure safety. Safe house = happy house

For example, the FHA will certainly guarantee a mortgage if the home buyer’s FICO score meets the minimums (e.g; 580 or higher). Also, if the borrower is a legal resident of the United States; and, if the borrower’s month-to-month earnings are reasonable regard the household’s monthly debts.

The FHA releases a series of such standards, FHA mortgage guidelines. Loans that meet FHA guidelines can be insured, and the lenders surely approve these loans.

FHA guidelines also consist of stipulations for certain “programs”, which may fall outside the spectrum of the typical mortgage applicant.

An FHA 203k Construction Loan can be utilized by owner-occupants of a residential property, local governments, and other qualified non-profits. They can use the loan to purchase and/or renovate a residence with up to 4 units. Also, the loan can help with a multi-use structure with certain exceptions.

FHA Construction Loan Requirements

The 2 versions of the FHA construction lending loan: The 203k Standard and also the 203k Streamline work very similarly.

However, there are a couple of distinctions.

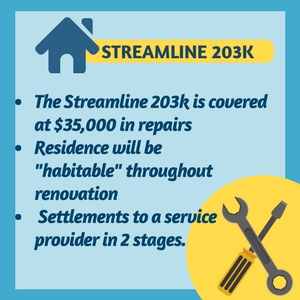

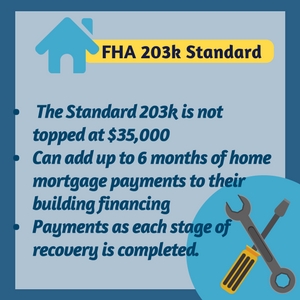

- First, the Streamline 203k cannot exceed $35,000 in repairs and requests fewer documents as part of the approval. The Standard 203k might exceed $35,000 as well as documentation demands are a little a lot more intense.

- Another improvement in between both 203k loan programs is that the Streamline 203k calls for that the residence be “habitable” throughout the renovation. If the home will certainly be unlivable for any reason at any time, the use of the Standard 203k is required.

- A 3rd improvement is that, with the Streamline 203k, settlements to a service provider could be taken care of in two stages. The initial payment can be made at the beginning of the job (i.e. 50 % to start the work); as well as, the 2nd settlement could be made at the project’s conclusion (i.e. remaining 50 % on the work).

- With the Standard 203k, payments are made differently. There is an assigned “consultant” which monitors construction, making payments as each stage of recovery completes.

Which 203k Construction Loan is right for me?

The two 203k programs additionally vary in just what kind of job can be executed as well as in their 203k loan rates. The FHA program guidelines consist of an extensive list.

FHA 203k Streamline

This construction loan is best for repair/replacement/or upgrade of roofs, gutters, existing HVAC systems, plumbing, and electrical systems, and existing floor covering.

It also covers small non-structural makeovers including outside and interior paint, insulation, weatherization of windows and doors, ease-of-access improvements, and lead paint stabilization.

It also covers small non-structural makeovers including outside and interior paint, insulation, weatherization of windows and doors, ease-of-access improvements, and lead paint stabilization.

It allows for a few larger renovations so long as the repairs are non-structural to the basement (including waterproofing), door and window replacements, and well or septic tank replacement and repair. Finally, the Streamline version of the FHA building loan can cover the purchase and installation of basic appliances.

FHA 203k Standard

This construction loan covers more significant repairs, like moving a load-bearing wall, repairing architectural damages, repair requiring in-depth illustrations or architectural exhibits, and improvements that need a strategy customer.

The Standard FHA building loan also covers brand-new construction, area additions, landscape design, and other site amenity renovations.

The Standard FHA building loan also covers brand-new construction, area additions, landscape design, and other site amenity renovations.

In short: any type of repair needing a work schedule longer compared to three months, rehab activities that call for more than two payments each specialized service provider, and improvements that result in work not starting within 30 days after loan closing.

To summarize, the Streamline lives up to its name – less paperwork for the customer, much easier for the loan provider to authorize, and convenience in the draw timetable. The Standard 203k FHA construction loan is for “bigger tasks” and more substantial long-term repairs.

Both types of FHA new construction loans can be advantageous for those seeking to purchase and also restore before moving to your house.

FHA Construction Loan FAQs

Have any more questions? We love to answer them!

What are the current 203k construction loan rates?

Mortgage rates fluctuate depending on the current state of the market and the economy. However, rates for FHA home loans are much lower than they are for other types of building loans, and you can use our site to help you find the best deals.

Take a look at the best FHA construction loan lenders. Your personal info is not required to get started, and the information you do provide is 100% protected with our SSL encrypted website.

How long does it take to close on a house with a 203k construction loan?

FHA construction loans can be closed in as little as 30 days. It often takes closer to 45-60 days because these sorts of building loans involve the government, the lender, and the applicant. But for many homebuyers, the wait is well worth it considering that you often get a better deal with an FHA loan.

What credit score do you need to get a 203k construction loan?

The Federal Housing Administration allows credit scores as low as 580, but most construction loan lenders require a score of closer to 620 (with lower scores usually requiring higher down payments.) Still, that’s a lot easier to manage than the 720+ credit scores required for traditional new construction loans.