Having bad credit can seem like a death sentence for the goal of home ownership. Fortunately, that doesn’t have to be the case as there are many programs that help people secure bad credit home loans in Colorado.

These programs range from federal loans, to local grants, but all can help you achieve the dream of homeownership even with a bad credit score.

What’s a Credit Score?

Your credit score is simply a measure of your financial history, and how responsible you have been with credit.

If you have a long history of responsible managing debt and make all your payments on time then it’s likely your credit score is high, and likely to be low if you have little history or have lots of missed payments.

Get Help Pre Qualifying for a Colorado Bad Credit Home Loan – Click Here!

In terms of actual numbers, most lenders are looking for borrowers to have a score of at least 620. For those under this score it doesn’t automatically prevent you from securing a mortgage.

The government and state of Colorado both have multiple programs that can help people in this situation get approved for a mortgage.

In addition to that, credit is not the only criteria for acquiring a home loan, and improving these can help offset less than perfect credit.

Additional Factors

As mentioned, credit isn’t the only thing lenders look at when deciding whether to approve a mortgage application or not.

There are a host of other factors that also come into play, and exceeding in these might sway the lender despite a poor credit score.

The reverse is also true, even a great credit score would be hard pressed to win an approval if the following items are in bad order.

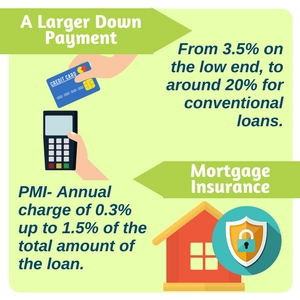

Down Payment

Probably the next most important requirement for a mortgage is the down payment. This is the money you put down at the beginning of the loan, and is typically expressed as a percentage of the total homes price.

Coming to the lender with a larger down payment is a good way to offset a poor credit score.

For a conventional loan, usually 20% is the required down payment amount. Other types of loans of loans may have less; for example the FHA loan only requires 3.5%.

Keep the percentages in mind to figure out how much more you should bring to the table.

Mortgage Insurance

Mortgage insurance is also another common aspect of bad credit and low down payment loans. Private mortgage insurance, or PMI, is an extra fee paid to help offset some of the risk for the lender.

The fee is generally a percentage of the total cost of the loan due annually. This is generally 0.3% to 1.5% depending on the exact terms of the loan and how risky the borrower is.

PMI is generally going to be a requirement for many bad credit loans, and it’s important to keep in mind as it is an extra free due as part of the home buying process.

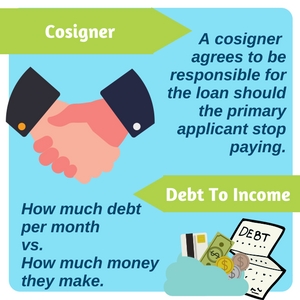

Cosigner

Another great option for securing a bad credit home loan in Colorado is to use a cosigner.

A cosigner is someone who agrees to also be responsible for the loan, and agrees to take over any payments should the main borrower not keep up with payments.

What’s great about a cosigner, is that the lender will also take into account their credit rating. Since they agree to be responsible for the loan, their credit score is also factored into the loan approval process.

Having a high credit score cosigner can really help get an application approved.

Debt To Income

Another important aspect to consider is your debt to income ratio. This is a measurement of how much debt you have versus your income, usually expressed as a monthly percentage.

The lower the number the better, as it means you have more free income to take on other debt, or pay for emergencies.

In general, lenders look for borrowers to have a debt to income ratio of 43% or less. While that’s generally the maximum, having a lower ratio is always better.

If your ration is significantly low, then it can help to offset a bad credit score.

The key here is just to make sure that you have as little debt as possible. Not only does this make you a more attractive borrower in the short term, but it also will help build credit in the long term as well!

Bad Credit Home Loans Colorado

If you’re living in Colorado with bad credit and are looking to buy a home then there are several great options open to you.

These programs come in a variety of different forms, and include everything from easy to acquire loans to grants that can help up your down payment.

It’s important to understand the ins and outs of each of these, as each one as their own set of requirements as well as benefits.

FHA Loans

One of the most popular types of loans for bad credit borrowers is the FHA loan. This is a government backed loan, that in general has lower requirements for both credit and down payments.

This makes it easier to acquire than a conventional loan.

The FHA loan is also very popular due to the fact that the down payment required is only 3.5%. Compare to a conventional loan which requires 20%, and this makes it much easier to get.

In order to qualify for this low down payment you’ll need a minimum credit score of 580.

For those lower than this, the FHA is actually available for scores as low as 500. In cases under 580 however, the borrower will need to come with at least a 10% down payment to make up for the increased risk.

VA Loan

For veterans with bad or even no credit the VA backed home loans are an excellent option. These are available nationwide, so are an option for Colorado residents as well.

The VA loan, the the FHA loan, is government backed and due to this provides a lot less risk for the lenders.

What’s great for bad credit borrowers about this particular loan is that it doesn’t have a set credit score requirement.

It also can be acquired for no down payment in some cases as well. This gives a lot of room for a bad credit borrower to come to the table with a large down payment to offset their credit score.

USDA Loans

Another great option for those looking to move to rural locations is the USDA loans. These are federally backed loans that are given to individuals who are looking to move to qualified rural locations in the country.

Their website has a map of what locations qualified, and it does take up a significant portion of the country.

While loan loan typically requires a credit score of 640+, those with lower can still apply. They will have to go through a process known as manual underwriting, which means a real person will take a look and make a decision on the application.

This takes a bit more time, but can work in the borrowers favor as the person looking at the application can take into account all the circumstances.

If you have worked on other areas to offset your credit, then this is a great opportunity to highlight those!

State and Local Programs

Colorado Home Buyer Tax Credit

The Colorado tax credit is a Colorado specific program that helps reduce the overall cost of your mortgage.

Qualified first time home buyers are able to reduce tax liability based on interest paid on their home loan.

This overall reduces the amount spent per year on the mortgage itself, which naturally reduces your debt liability. This is always a good thing, and can help swing a mortgage decision in your favor.

Colorado Housing and Finance Authority

Another Colorado program is the Colorado Housing and Finance Authority, or the CHFA. They help low income families secure housing both through renting and home ownership.

They have a variety of programs, including financial courses, special low down payment loans, and grants for down payment assistance.

This wide range of services makes them an excellent resource for anyone looking to buy a home in Colorado.

Their programs do have some credit requirements as well as maximum income requirements, so it’s definitely worth checking out their website to see if you qualify.

Teacher Next Door

Another example of a local program available in Colorado is the teacher next door. Specifically this program is available in Denver and Aurora, but may also be available in other Colorado cities as well.

This program provides teachers grants, down payment assistance, and good rates on home loans.

The program is also available to first responders such firefighters, police, and EMT. The also provide advice and knowledge in addition to their financial services.

The Teacher Next Door Program is a good example of a local program that has some specific requirements.

There are many programs all over Colorado that cater to specific groups of people like this, so make sure to do some research to see what’s out there in your area.

What’s a Good Credit Score For Buying a Home In Colorado?

Overall, your credit score is simple a number representing how much of a risk you are to bank. The higher the score the more dependable you have proven to be, and in turn the less of a risk you are.

Credit scores range from 350, all the way up 850, and are reported by three main agencies. These scores can differ from agency, so find out which one your lender uses so you can arm yourself with the best knowledge.

Most conventional loans are looking for credit scores of 620+. Individuals above this number have demonstrated they can handle credit and debt, and present less of a risk of defaulting on their loan.

If your score is below this, then this is a good number to shoot for, at least initially. Higher is always better, as the lenders will give better rates to those above 700 or 750.

Bad Credit Home Loans Colorado

Having bad credit doesn’t mean you can’t buy a home. There are a lot of programs that can help bad credit buyers in Colorado achieve the dream of home ownership.

Bad credit isn’t a life sentence either, you can always rebuilt it. Even if you have a bankruptcy or foreclosure in your past, working hard paying off debt is a sure fire way to get that score back up. Don’t let bad credit stop you from becoming a homeowner!

FAQ

Can I still buy a home with a bad credit score in Colorado?

Yes! There are many programs that can help low credit buyers acquire a mortgage. These programs are often either government backed, or help provide more money to the lender; both of which lower the lender’s risk.

What Options Do I have For Bad Credit Home Loans In Colorado?

There are a wide range of programs, both federal and local. This includes things like the FHA loan which can be acquired with as low as a 500 credit score, or local programs like the Teacher Next Door which can provide down payment assistance and other financial services.

Can I rebuild a bad Credit Score? How Long Does it take?

Yes you can! The best way is to be responsible with your credit and debt. Make sure to always pay your payments on time, and reduce the overall debt you have.

How long it takes is very variable. It depends on how long you’ve had credit for, and what sort of history it has.

For example, someone with a bankruptcy in their past is going to have a more difficult time rebuilding than someone who doesn’t.