Looking for Illinois home loans for single mothers can sometimes feel frustrating. Heck, looking for home loans in any situation can be frustrating.

You have to find the perfect house, shop around to find a lender who’ll give you good terms, and navigate the complicated paperwork. Then you have to cough up a huge down payment and find a way to afford the regular monthly payments.

When you’re also trying to raise a family on your own, all that can be overwhelming. That’s why we at Home Loans For All want to do everything we can to help.

Get Help Pre Qualifying for an Illinois Home Loan For Single Mothers – Click Here!

In this article, we’ll cover some of the best Illinois home loans for single mothers. We’ll explain why the conventional mortgage program might not be for you and then help explain the programs that are offered by the government at the state and federal levels.

Finally, we’ll cover some additional Illinois home buyer assistance for single moms that may help you get accepted or help you make payments on your mortgage.

Best Illinois home loans for single mothers

The basic Illinois home loan option is what’s known as a conventional home loan or conventional mortgage. Conventional home loans are expensive and inaccessible to many single mothers and home buyers with a less than upper-middle-class income.

The terms of most conventional home loans include:

- An initial down payment of 20 percent of the home’s total value

- A debt-to-income ratio of 40 percent or less

- A minimum credit score of 660 (some cases may even require a minimum credit score of 700!)

- Variable interest rates

- Payment of Private Mortgage Insurance every month for the first fifth of the payment period

The real killer here is the down payment. Even if you’re in a comfortable enough economic position to meet the credit and income requirements, and even if you’re confident about your ability to make monthly payments on a mortgage, being asked to pay thousands of dollars all at once is simply beyond the abilities of many home buyers.

Fortunately, there are MUCH better options for Illinois home loans for single mothers.

Welcome Home Illinois Loan Program

The “Welcome Home Illinois” home loan program is a 30-year fixed-rate mortgage with an interest rate that is guaranteed to be lower than the interest rate of a conventional home loan.

The income and credit requirements of the loan vary from lender to lender, and they’re certainly not as lenient as the loans we’ll talk about in the next two sections. However, they come with one major benefit: up to 7500 dollars worth of down payment assistance.

As long as you pay $1000 of the purchase price, you shouldn’t have to pay anything else up front. That makes this the perfect loan for anyone who knows they can handle the monthly payments but is concerned about paying thousands of dollars all at once.

Learn more about this helpful home loan for Illinois single moms here!

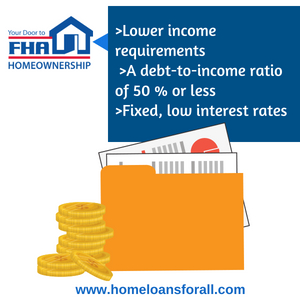

Illinois FHA loans for single mothers

FHA loans have long been one of the most popular programs amongst Illinois single mothers, and it’s not hard to see why. With low eligibility requirements, availability anywhere in the state, and fixed low interest rates, these loans are accessible and affordable.

If you have a credit score of 580 or higher, your down payment on an FHA loan will only be 3.5 percent of the total value of the home, which is much cheaper than the down payment on a conventional mortgage.

However, many lenders will accept credit as low as 500 for these types of loans, so long as you can also provide alternative forms of credit (like proof that you pay your utility bills regularly) or are willing to pay a slightly higher down payment.

The average terms of an FHA home loan for single mothers include:

- An initial down payment of 3.5 to 10 percent of the home’s total value, depending on your credit.

- A debt-to-income ratio of 50 percent or less

- A minimum credit score of 580 (500 in some cases)

- Fixed, low interest rates

- Payment of Private Mortgage Insurance every month for the entirety of the payment period.

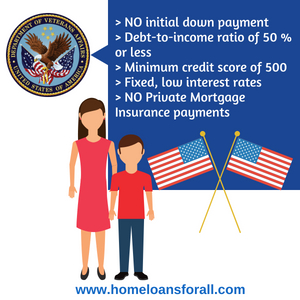

Illinois VA loans for single mothers

VA loans are similar to FHA loans in that both are insured by a branch of a federal government, and that both have more lenient credit and income requirements as a result of that insurance.

For FHA loans, the organization involved is the Federal Housing Administration. For VA loans, it’s the Department of Veterans’ Affairs.

As you may have guessed, this means that these loans are only available to Illinois single mothers who are also former members of the armed forces. The lack of general availability is a disappointment, but the incredible terms of these loans more than make up for it.

In other words: if you can apply for a VA loan, you absolutely should!

The average terms of a VA home loan for Illinois single mothers include:

- NO initial down payment in most cases

- A debt-to-income ratio of 50 percent or less

- A minimum credit score of 500

- Fixed, low interest rates

- NO Private Mortgage Insurance payments

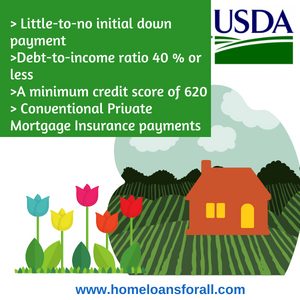

Illinois USDA loans for single mothers

USDA loans, also known as Rural Development loans, are designed to encourage prospective home buyers to move into rural areas of the state. For obvious reasons, those looking for a home in or around the city of Chicago need not even consider applying.

But for the rest of us, USDA loans are among the cheapest around even if they have stricter eligibility requirements than FHA or VA loans.

The average terms on USDA Illinois home loans for single mothers include:

- Little-to-no initial down payment

- A debt-to-income ratio of 40 percent or less

- A minimum credit score of 620

- Fixed, low interest rates

- Conventional Private Mortgage Insurance payments

Illinois home buyer assistance for single moms

Even if you’ve received one of the Illinois home loans for single mothers mentioned above, you may still require further assistance with making the payments or affording the home. Here’s some assistance offered by the government and by lenders that can help you afford home loans for single mothers in Illinois.

Firstly, once you’re paying off the home you can save money by taking advantage of the state’s homestead tax exemption. This allows you to withhold a certain amount of money from your property taxes while you’re living in a property that you are also paying off. In Illinois, this tax credit can save you up to $7000 in Cook County and up to $6,000 in all other counties.

Down payment assistance can also help you save money if you’ve been approved for a loan. The state of Illinois only offers down payment assistance in connection with certain mortgage programs (see our section on Welcome Home Illinois above for more info), but individual cities will often have down payment assistance programs in place.

Chicago’s Home Buyer Assistance Program for example, will offer low income home buyers (including single mothers) five percent of the value of the home in funds that can be used to pay off the down payment and/or the closing costs on a mortgage.

Take a look in your own area and see what programs are available!

Assistance for single moms with bad credit

Credit is the first thing a lender looks at when they decide to approve or reject your mortgage application. So when you have bad credit, it can be very difficult to find Illinois home loans for single mothers.

One thing you can do to find a home loan with bad credit is to seek out a co-signer. A co-signer is a relative or close friend who agrees to tie their credit to your property, allowing you to apply for the mortgage as though you had better credit than you actually do.

This makes it easier to get Illinois home loans for single moms and will also give you better terms on the loan once you’ve been accepted. However, the co-signer absorbs a lot of risk and may be asked to help make a mortgage payment if you miss a month.

If you can’t find a co-signer and absolutely cannot afford a home loan, you might want to try a rent-to-own contract instead. This lets you apply for a rental contract in the short-term (with the lower credit requirements and cheaper payments that implies) for a property that you can later buy outright.

Finally, you can always try to repair your credit. Conventional wisdom will tell you that you can only do this with the help of an agency, but that is simply not true. There is nothing that a credit repair agency can do for you that you cannot do for yourself by paying your bills, reducing your debts, and applying for secured credit cards.

You can learn more about how single mothers in Illinois can repair their credit by reading this article.

Conclusion

Illinois home loans for single mothers aren’t too hard to find when you know where to look. Even if a conventional mortgage is beyond your reach, you might be able to find a lender offering FHA, VA, or USDA loans who’s more willing to work with your financial needs.

Single mothers deserve our respect, our admiration – and perhaps most importantly, they deserve to live safely and securely in a permanent home of their own.